The best mobile banking apps: What makes them work?

Post Author:

CacheFly Team

Categories:

Date Posted:

March 10, 2014

Over the past decade, consumers have been increasingly conducting much of their banking and e-commerce activity online. In the past few years, online banking services, driven by the advancements in mobile technology and software, have migrated from desktops and laptops to smartphones and tablet computers. Offering a robust banking app is a big differentiator between competing financial institutions.

So what are the best mobile banking apps, and what features make them stand out among the also-rans? On the other hand, what are some missteps banks are making when developing their mobile software? Let’s take a look at the haves and have-nots when it comes to mobile banking.

Shining a light on the best mobile banking apps

The leading apps for conducting banking activities share three main attributes. Ease of use is probably the leading factor: If a banking app has a poorly designed, confusing interface, customers will either use the bank’s website or leave for another bank with a well-designed app. An attractive app design contributes to the overall usability of a banking app; one could say that these two factors are essentially one in the same.

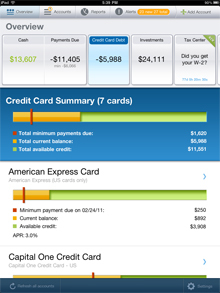

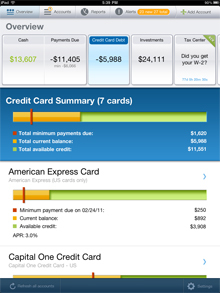

Finally, a collection of robust features allows the best mobile banking apps to stand out from the pack. The ability to make a deposit using a smartphone or tablet by simply taking a photo of a check is a feature that is often highlighted in banking advertisements. Location-based coupons or rewards are some other features customers can enjoy; the American Express mobile app is known for this feature.

Banks that are primarily focused on mobile services tend to provide a better experience for their customers. BBVA Compass actually lets customers sign up for mobile banking without having to enroll in the bank’s online services beforehand. This is a great feature for customers always on the go who rarely find themselves in front of a computer screen.

Other innovative features offered in the best mobile banking apps include voice recognition functionality that allows users to pay bills by speaking into the app and ATM locators to help customers find banking locations on their smartphone when traveling.

Supporting alternative mobile platforms

While the Android and iOS platforms remain dominant in the mobile space, some financial companies have earned accolades by offering support for alternative platforms. Bank of America recently introduced a Windows 8 app optimized for Microsoft’s new touch screen interface. BBVA also built an app specifically for the Kindle Fire, a platform largely based on Android but with notable differences.

It is important for banks not to force customers into a mobile platform choice. Support for as many platforms as possible, including BlackBerry and Windows 8, gives more consumers the option of using a bank’s mobile services.

Smaller banks with winning mobile features

The best mobile banking apps aren’t limited to financial services giants: Smaller firms also build quality mobile banking experiences. City Bank Texas allows customers to deactivate a potentially fraudulent debit card by flicking a switch, to access balance info without logging in, and to unblock foreign transactions easily.

Mercantile Bank of Michigan entered into a partnership with PayPal — the first ever in mobile banking — and linked its app with personal financial management software. Adding support for mobile video technology is another innovation sure to please their customer base.

Mobile banking app missteps annoy customers

Though it’s important that banks provide innovative mobile features to their customers, they also need to get the simple things right. A Harris Interactive mobile banking survey revealed that a slow-loading mobile bank website would drive 28 percent of all customers to a competitor’s Web page, and 18 percent of users would never return.

Seventy-two percent of those surveyed want a mobile banking experience that works all the time. Nearly two-thirds want an app that is fast and responsive. Excellent mobile app user interface programming is able to provide a responsive experience to customers, but banks need to ensure their websites and back-end processes run quickly.

It is necessary for banks and financial service companies to take the right steps to ensure their mobile apps are responsive. In many cases, partnering with a content delivery network (CDN) is a smart move that allows the fastest possible experience for mobile users.

What a content delivery network provides for mobile banking

The industry’s leading CDNs are able to accelerate website and mobile app delivery in a variety of ways. Offloading images and other content from a bank website’s infrastructure improves the efficiency of content delivery. TCP-anycast routing gets mobile websites to a customer’s smartphone or tablet securely at blazing speeds. Providing access to the Internet’s leading peering points ensures fast content delivery no matter the user’s location.

A 100 percent service level agreement means a mobile banking app works all the time. Seamless scalability means that as a bank’s customer base grows, their mobile website and banking apps still provide top-of-the-line performance.

As mobile banking continues to grow in user acceptance, the smart financial service companies make sure their customers get the best possible experience from mobile apps and websites. Working with a content delivery network helps to make this synergy possible.

Photo credit: Wikimedia Commons

Product Updates

Explore our latest updates and enhancements for an unmatched CDN experience.

Book a Demo

Discover the CacheFly difference in a brief discussion, getting answers quickly, while also reviewing customization needs and special service requests.

Free Developer Account

Unlock CacheFly’s unparalleled performance, security, and scalability by signing up for a free all-access developer account today.

CacheFly in the News

Learn About

Work at CacheFly

We’re positioned to scale and want to work with people who are excited about making the internet run faster and reach farther. Ready for your next big adventure?